Successful Traders

Aim for a Percentage Increase in the Account Every Month Rather Than Chasing Pips

March 25, 2021 | 1:39 pm | Successful Traders

March 25, 2021 | 1:39 pm

Successful Traders

It’s important to focus on building consistency and minimizing losses, more than quick returns at the start, That’s Jane Advice

Jane B. 34 years old, from Scotland.

“Aim for a percentage increase in the account every month rather than chasing pips”.

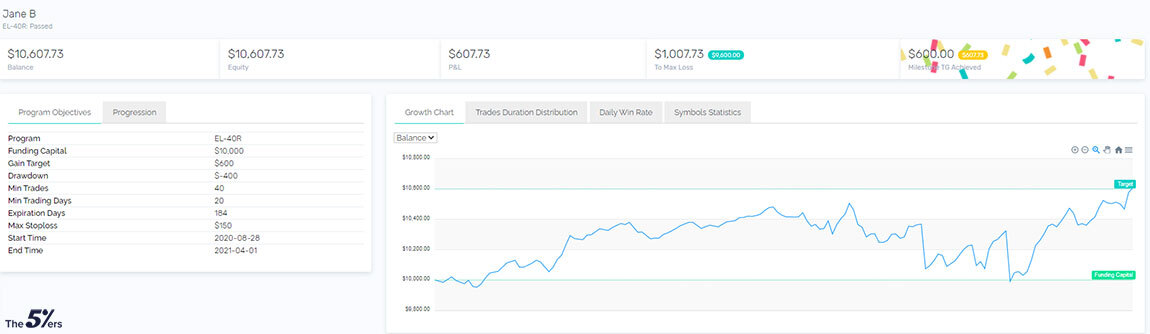

Jane has just successfully passed our Level 1 with a great trading plan and has become a forex funded trader.

She is now one of our funded traders and is trading with a 40K forex funded account on our platform.

His next mission is to reach 10% of profit and double his funds to 80K.

We spoke with Jane about her trading plan, insights, and lessons gained while trading in the Forex market and on our platform as a funded trader.

Click here for more Inspirations lessons and interviews from our professional funded traders

- How were you introduced to trading?

A friend of mine is a professional trader.

- After how much time did you become a consistent trader?

After a full year of live trading, and getting experience of the ebb and flow of the market at different times of the year, I felt then that I had acquired enough basic experience to be consistent (but I do still feel like I have so much to learn!)

- Do you have a specific trading plan?

I use a mix of indicators and fundamentals to make trading decisions off of the daily timeframe. Entries and exits are carried out on the 1-hour timeframe and I monitor trades into the smaller timeframes too when the markets are volatile.

- Please describe your trading routine?

I used to hold over the weekend, but given that certain fundamental news announcements can affect the markets on re-opening, I close all my trades on a Friday. On Sunday evening when the markets open I re-evaluate my plans for the week, have a rough idea in place, monitor, and carry out those trades as they appear throughout the week.

- Do you have any risk management techniques? If so, please, elaborate?

Maximum stop loss of 1.5% UNLESS there’s movement indicative of an institutional move. If this happens, I widen my stop loss to allow for the move to ‘breathe’, and more often than not, price re-enters the existing trend.

- What was your biggest challenge in trading, and how did you overcome it?

I had a couple of big losses that affected me psychologically and I panicked, deviated from my trading plan, and resorted to a couple of stupid trades that made the losses even worse. I thought that I’d almost certainly failed my evaluation, but I reviewed all of my trades, looked at what went wrong, considered the general market activity and my poor decision making, and got back into the evaluation mindset; this time really doing my best to minimize my losses. The turnaround was a success and I’m really glad I had the historic data on hand to help improve my future trades.

- What was the key moment of your trading career?

Passing this evaluation! All my life I’ve struggled with assessments and deadlines, and I very nearly let panic ruin things again. Thankfully I managed to overcome my psychological issues and make this a success.

- What do you think are the most important characteristics for maintaining a stable trading career?

An awareness for the desire to trade on impulse/panic. Yes, it might work out some of the time, but if you panic, overleverage, and the trade go against you, it could be disastrous. Trading is definitely playing the long game and I think it’s important to focus on building consistency and minimizing losses, more than quick returns at the start.

- Do you apply any mental/psychological routines while trading? Please elaborate.

No specific mental/psychological routines. I know that if I’m really tired or stressed I tend to opt out of trading on those nights. I’m also aware that the markets don’t need to be traded every single day. When I first started out, I was caught out by consolidating markets for that very reason.

- What was your strategy for successfully passing The 5%ers’ Evaluation Program?

Have a trading plan, stick to the plan, and be happy in trading portions of a trend as opposed to trying to trade it all. I aim for a percentage increase in the account every month rather than chasing pips; I feel that works best for me.

- Please share your recommendations for online resources that were/are significant in your trading development.

No Nonsense Forex – Youtube I enjoy the market commentary podcasts of Peter Schiff and Macro Voices weekly. My background and work outside of Forex are in manual therapy, Psychology, and Human Anatomy and Physiology. So I read a lot about mindset and how people work within societies. Jordan Peterson, Brett Weinstein, Carl Jung, Viktor Frankl. Not specific to Forex, but I feel a lot of this further reading makes sense of market bubbles and abnormal economic conditions.

- Would you like to share anything else with us?

I just want to say thank you and that I’m very thankful for the opportunity to be able to trade a live money account with you. This is something I would be unable to accomplish on a large scale on my own, and being a part of The 5%ers makes this possible. I’m excited to get started on Level 2!

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

Subscribe to our youtube channel.

Click here to check how to get qualified.

Click here to check our funding programs.

You must be logged in to post a comment.