We spoke with Kaci about her trading plan, insights, and lessons gained while trading in the Forex market and our platform as a funded trader.

Click here for more inspirational lessons and interviews with our professionally funded traders.

Watch The Interview With Kaci

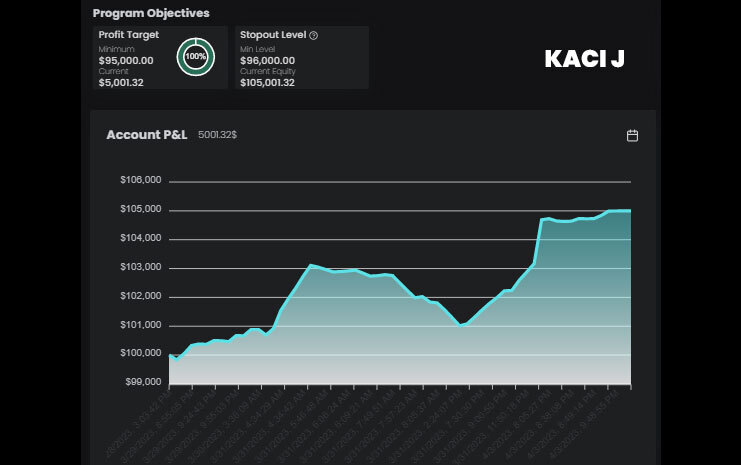

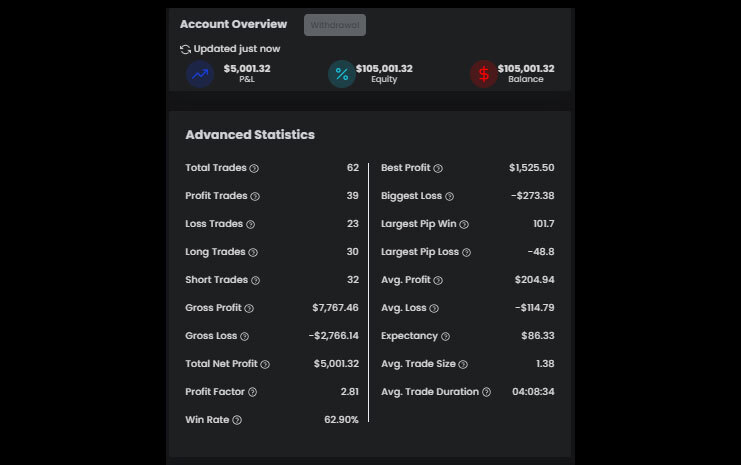

Kaci’s $75K Bootcamp Account

Kaci’s $100K Bootcamp Account

- Tell us a little bit about you.

I am from the Detroit metro area in the United States. I’m a twin. My twin has zero interest in learning to trade, so there’s no genetics at play in the interest 😉. I’ve been trading off and on for 6 years, more consistently over the last 2 to 3 years. I work full-time and trade and have determined that swing and intraday trading best work for my lifestyle.

- How long have you been trading?

Almost 6 years. More consistently over the last 2 to 3 years is when I got serious. I am a swing trader.

- Briefly describe your Trading Plan and how it contributes to your success.

My trading plan primarily consists of trading reversals with a combined tool of Fibonacci retracements and extensions. Specifically, a play that focuses on shallow retracements and failed targets. When the target isn’t reached, I trade the reversal to at least the 38.2 Fibonacci level.

- Share with us a challenge you faced in your trading career and how you overcame it?

I still face challenges today. I have found that when I become so engaged with a potential trade setup and have my mind stuck to that, I tend to throw logic out of the window. Time and time again, it proves to be a failure.

I did this with my first testing account with The5ers. It was when I separated my emotions from the trade idea and focused solely on the process that I saw success.

As I mentioned, it’s something that I still battle with, but I have to step away — refocus and regroup.

- How did you adjust risk management to your trading personality?

Trading smaller lot sizes. As I mentioned, I work full-time. I have a dedicated day to mark up my charts to find potential setups.

Initially, I’d trade crazy lot sizes. Sometimes, it would work, and most times, it didn’t. I realized that when I trade lower lot sizes, my anxiety is reduced, and I don’t have to babysit my phone — “to make sure everything is ok”.

- Describe a key moment in your trading career.

A key moment in my trading career was when I understood the power of leverage and forex. I took a $150 account to nearly 5 figures in 3 weeks. Granted, I blew that account in 3 days, but it showed me that once I mastered the skill and the risk components, I could literally become proficient enough to print my own money.

I’d always been interested in learning to trade stocks as a young adult. But when I understood how leverage worked in this space, I knew that if I came up with a plan to effectively manage risk, one day, this skill set could change my life.

- How long it took for you to become a consistent trader, and what aspects did you change that helped you to become consistent?

This is something that I am still working on — daily. When I stick to the rules, I’m consistent. When I don’t, and I let emotion take over— I lose…every time. I think this area is something that takes immense discipline to master.

- What is your mental/psychological strength, and how did you develop it?

For me, when I focus on the process only and don’t marry myself to a trade idea, I am able to easily separate emotions. When I operate in this space, when a trade does not go my way…I can quickly cut my losses, re-evaluate and re-approach. I learned quickly that this approach is best and will always allow me the space to think with a clear and level head. When ego and pride are involved, which, if I’m honest, sometimes they are involved, is when I find myself mentally weak.

Seeing the results I get when I operate from a place of the process is what helped me develop the mental fortitude for trading.

- What was your strategy to successfully pass The5ers’ First Level?

I trade with a combined Fibonacci retracement and extension tool and a multiple timeframe analysis. The play I trade is called “80/20”. I didn’t invent it or discover it. But I fell in love with it when I first learned it.

It is called the 80/20 because when the price makes a shallow retracement, less than the 38.2 Fibonacci retracement level, 80% of the time, the price will stall out at a shallow Fibonacci extension level and reverse to retrace at least to the 38.2. 20% of the time, the price will continue to the matching Fibonacci extension and complete the sequence.

These setups can happen in every timeframe: 15 minutes, 1 hour, 4 hours, daily, weekly, or even monthly. It’s really powerful and easy to identify once you’ve completed a timeframe analysis.

- How is trading for The5ers different from trading by yourself?

There’s a sense of accountability and also a sense of possibility. Going back to the power of leverage…being funded allows a trader literally unlimited possibility in earning potential. Granted, a trader will likely still face some of the challenges they would on their own, but there’s definitely a sense of accountability that comes into play.

- What would you recommend to someone who is just starting with us?

Absolutely. I like The5ers. I like what you all are doing. I think the program is achievable, and so far, my experience has been great.

- Share online resources that were/are significant in your trading development. Names and links are appreciated.

My YouTube channel

- Would you like to share anything else with us?

👉 If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

👉 Click here to check our funding programs.

Follow us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView