- Tell us a little bit about you.

Apart from trading. I’ve been working in one of bank company as a data engineer. I love quantitative trading. Using data, numbers, and everything to create a trading strategy.

- How long have you been trading?

For almost 7 years now, I am a swing trader.

- Briefly describe your Trading Plan and how it contributes to your success.

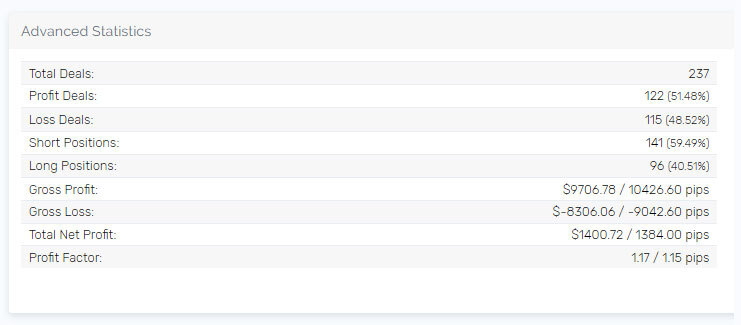

The trading plan is simple, using lower risk but not too low Risk-Reward ratio should be over 1. Wait for the right moment, step away from the market if you can’t control your emotion, and respect the market.

- Please share with us a challenge you faced in your trading career and how you overcame it.

I know that I am not suitable for manual trading because I cannot control my psychology. So I decided to learn more about quantitative trading, building strategy by coding and everything. This way I can overcome my weakness and continue trading in the market.

- How did you adjust risk management to your trading personality?

Based on backtesting/forward testing. I will try to avoid corelative profits/losses in a day. And also adjust risk per trade by looking at the backtesting result (maximum drawdown). If the maximum drawdown is looking huge then I will decrease risk per trade to some reasonable value.

- Describe a key moment in your trading career.

It would be the first time I got stopped out from my trading account because of my emotion. So that day I decided to learn more about trading and how to overcome my trading psychology. Then I start to learn more about quantitative trading.

- How long does it take for you to become a consistent trader, and what aspects did you change that helped you to become consistent?

It took around 3 years for me to realize that I am not a manual trading guy. Automated trading is my way to go.

- What is your mental/psychological strength, and how did you develop it?

I know my weakness is psychology in trading. But I am not giving up that easily. So I adapt my stubborn-ish to learn a new way to trade. That is automated trading.

- What was your strategy to successfully pass The5ers’ First Level?

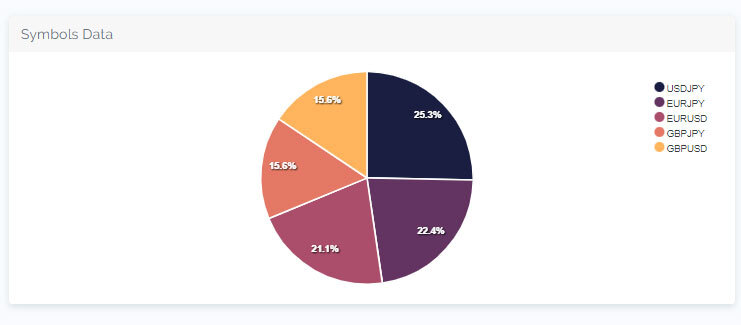

It is just a simple break-out strategy. The signal confirms from multiple timeframes. It will have a 50% chance or less to be in profit. So I need to make sure that the risk-reward ratio compensates for the losses.

- How is trading for the5ers different from trading by yourself?

They are not different. The rules of The5ers are flexible. So It suits me well.

- What would you recommend to someone who is just starting with us?

Keep trading, keep learning, and don’t forget to respect the market.

- Share online resources that were/are significant in your trading development.

https://www.youtube.com/@cwayinvestment, Chat with traders podcast

- Would you like to share anything else with us?

- Happy to join The5ers!

👉 If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

👉 Click here to check our funding programs.

Follow us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView