We spoke with Le about his trading plan, insights, and lessons gained while trading in the markets and our platform as a funded trader.

Click here for more inspirational lessons and interviews with our professionally funded traders.

I’m Santosh V, a passionate trader and a financial professional with a strong background in foreign exchange and trade finance. With over a decade of experience in the financial markets, I’ve built a solid foundation in macroeconomic analysis and currency dynamics, which deeply influence my trading approach.

My journey into trading began out of curiosity, but it quickly evolved into a disciplined passion. I specialize in swing and positional trading across forex, commodities, and indices. My strategy combines multi-timeframe analysis with tools like Ichimoku, Bollinger Bands, and Stochastic RSI, always aiming for clean technical setups with a minimum 1:2 risk-reward.

Over the years, I’ve learned that consistent profitability comes not from predicting the market but from managing risk, staying patient, and maintaining emotional discipline. Trading has taught me more about mindset than any other profession I’ve encountered.

Being part of The5ers is a meaningful step in my journey — a chance to scale, stay accountable, and also share back with the trading community. I’m also working on launching an educational initiative to guide aspiring traders with structured, no-hype trading systems.

I have been trading for 18 years.

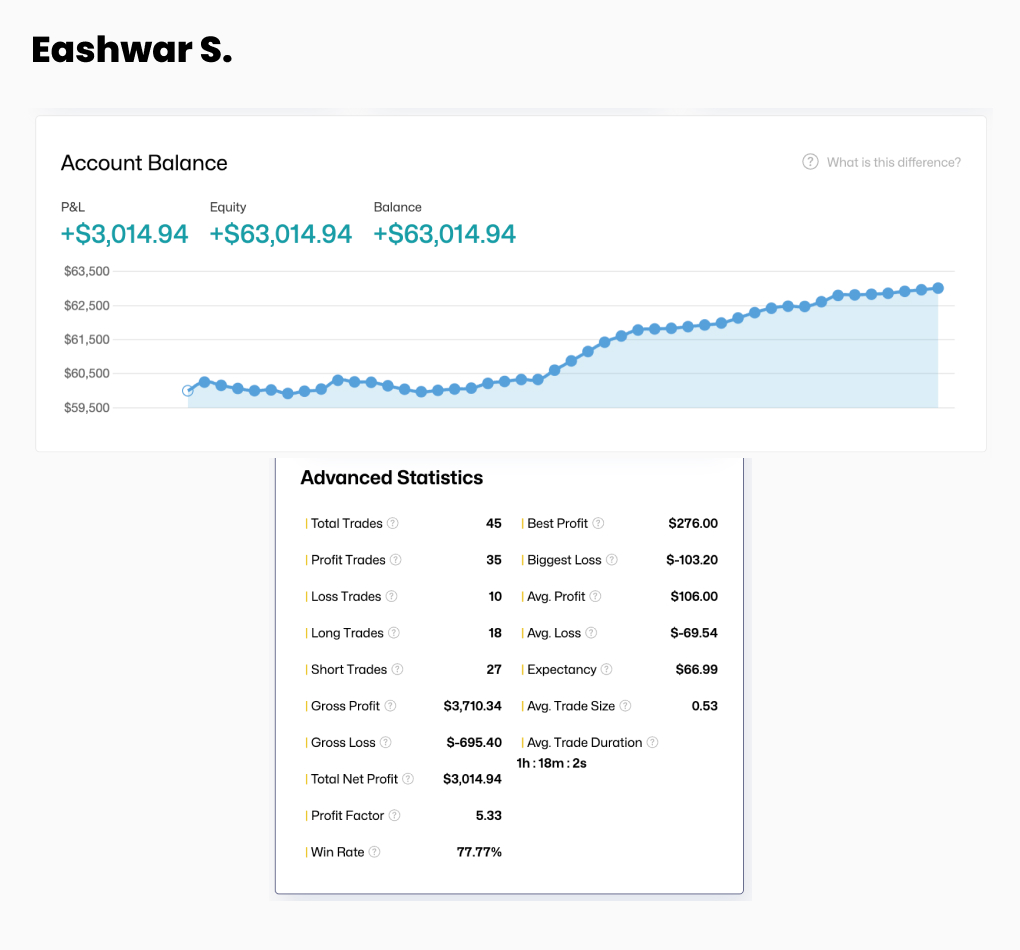

My trading plan revolves around high-probability setups using Bollinger Bands, and Stochastic RSI across multi-timeframes. I start with a top-down approach, confirming the macro trend on the Daily and 4H charts, then identifying potential entries on the 30M and 15M charts. I follow strict entry criteria including price action near key zones, multi-indicator alignment, and at least 3 confirmations. Every trade is pre-planned with a defined risk (1% per trade) and minimum 1:2 risk-reward ratio. This structure keeps me disciplined and consistent, filtering out emotional and impulsive trades.

One major challenge was dealing with overtrading and revenge trading after losses. This not only hurt my capital but also my confidence. I overcame it by incorporating a trading journal, taking daily screenshots of setups, and enforcing a strict 2-trade-per-day limit. I also added affirmations from “Trading in the Zone” to rewire my mindset, shifting focus from outcome-based to process-based discipline.

I discovered that I’m naturally driven and sometimes impatient, which made fixed lot sizing risky during emotional trades. I adjusted by implementing dynamic position sizing based on account equity and volatility. I never risk more than 1% per trade, and I calculate lot size based on the stop-loss in pips. I also use trailing stops based on the N-wave principle to lock in profits while minimizing exposure.

It took me around 18 – 24 months to achieve consistency. The biggest change was shifting focus from trying to “win” every trade to managing risk and following my edge. I also learned to respect news filters, trade only during high-probability windows, and stay flat during unclear market conditions. Journaling and visual tracking helped me identify strengths and avoid repetitive mistakes.

My greatest strength is emotional detachment and discipline under pressure. I built this by adopting a morning routine with affirmations, backtesting my strategy until I trusted it deeply, and training myself to accept losses as part of the game. I also started mentoring newer traders, which helped reinforce my own beliefs and boosted my psychological edge.

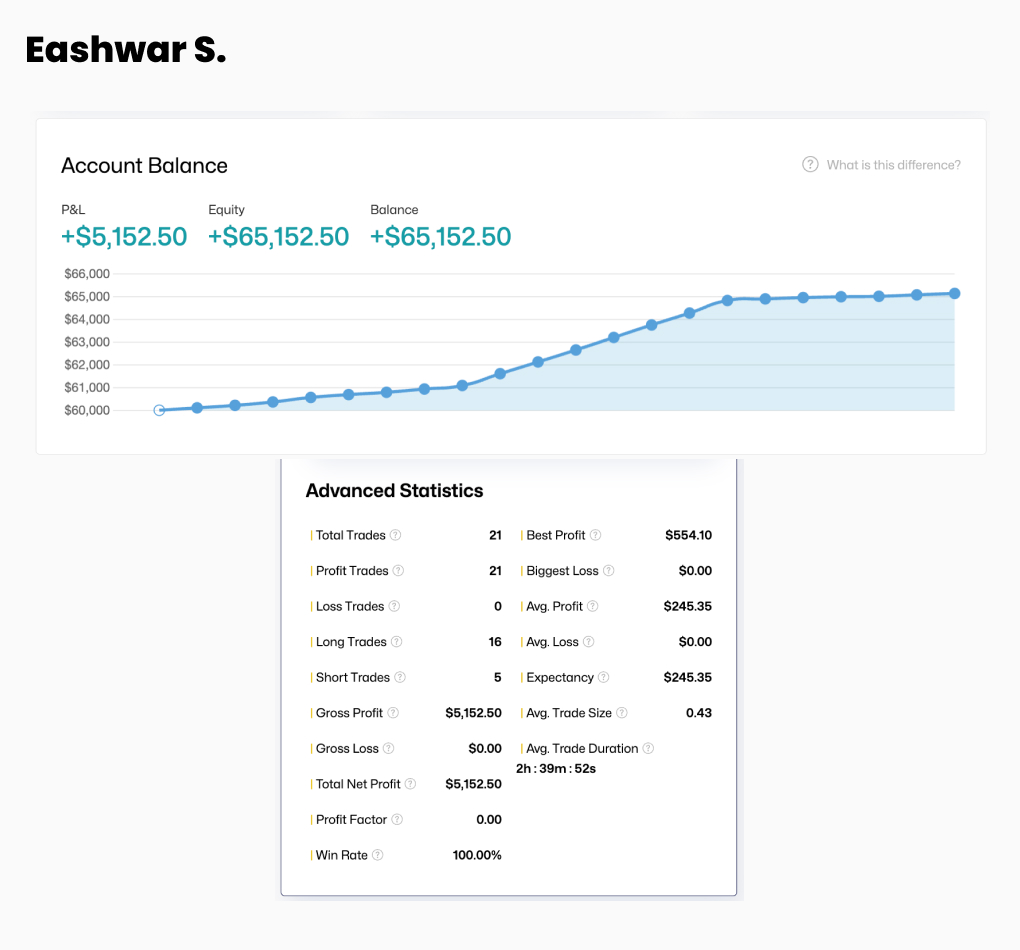

My strategy to successfully pass The5ers’ First Level was based on strict risk management, trading only high-probability setups aligned with the dominant trend.

👉 If you want to receive an invitation to our live webinars, trading strategy, and high-quality forex articles, sign up for our Newsletter.

👉 Click here to check our funding programs.

Follow us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView

The5%ers let you trade the company’s capital, You get to take 50% of the profit, we cover the losses. Get your trading evaluated and become a Forex funded account trader.

Get Your Forex Funded Trading Account

You must be logged in to post a comment.