Learn to think in terms of probabilities and statistics which enable you to trade with an objective state of mind with little emotions, That’s Edmund Advice

“Find a strategy that gives you a statistical edge in the market with positive expectancy”.

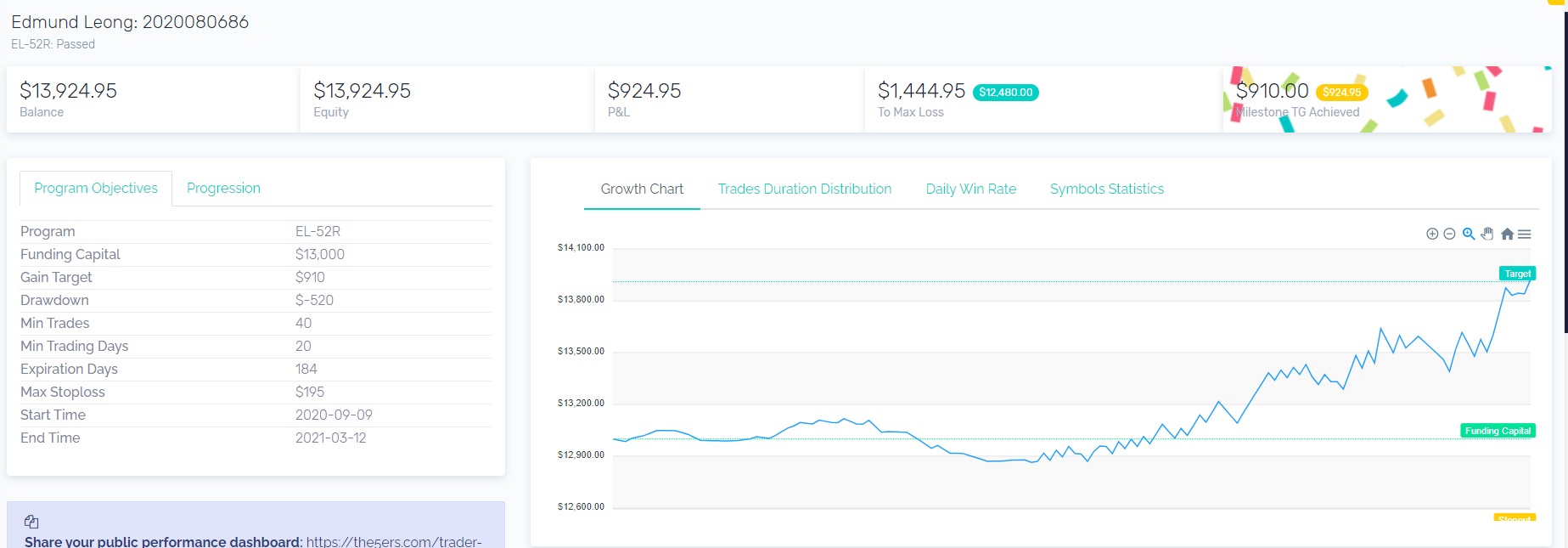

Edmund has just successfully passed our Level 1 with a great trading plan and has become a forex funded trader.

He is now one of our funded traders and is trading with a 52K forex funded account on our platform.

His next mission is to reach 10% of profit and double his funds to 104K.

We spoke with Edmund about his trading plan, insights, and lessons gained while trading in the Forex market and on our platform as a funded trader.

Click here for more Inspirations lessons and interviews from our professional funded traders

- How were you introduced to trading?

When I was in the army, I was finding something valuable to learn. I then came across a Youtube video on stock trading by Adam Khoo and started reading and researching more about it. A friend of mine then convinced me to venture into Forex instead of stocks.

- After how much time did you become a consistent trader?

I became a consistent trader after over 1year of trial and error. I only became consistent after I found a statistical edge in the market and had a paradigm shift in my psychology and mindset towards trading.

- Do you have a specific trading plan?

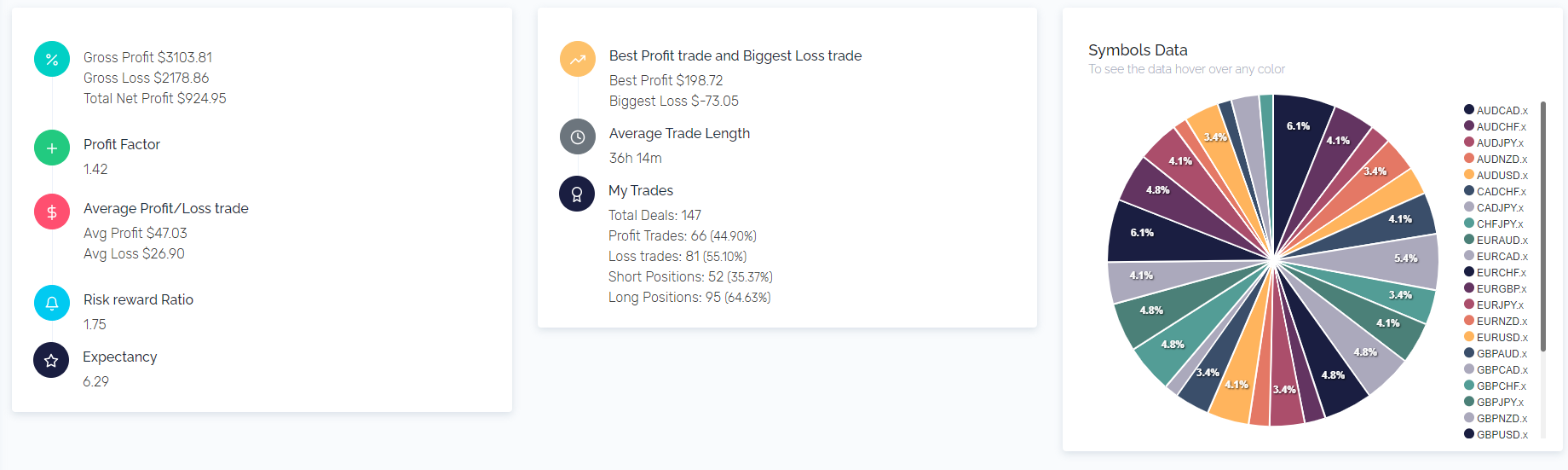

I look for currencies that are on a strong trend indicated by perfectly aligned EMAs on multiple timeframes. To look for high probability setups, I want to see a retracement back to one of the EMAs followed by other confluences such as Fibonacci level or support and resistance level and I will anticipate it to bounce off that level and continue the trend.

- Please describe your trading routine?

First thing in the morning, I look out for strong and weak currencies using the currency strength meter and mark out the pairs that I am going to be tracking for the day, and place alerts on them. Afterward, I will take a look at the news calendar to see if there is any upcoming major news. I always avoid trading 2 hours before any major news release. When I get an alert, I will then see if its a high probability set up. If there is one or more confluence, I will enter the trade and I adopt a fire and forget approach which means I will let my trade either hit my stop loss or hit my take profit.

- Do you have any risk management techniques? If so, please, elaborate?

1) Always have a Risk to Reward ratio of at least 1.33.

2) My stop loss is always between 1ATR and 1.5 ATR.

3) I adopt the 1% rule so I don’t risk more than 1% per trade per currency.

4) Do not overexpose your account by having more than one position of the same currency (eg. USD/CAD & USD/CHF). If you really want to trade both then go half the risk on each pair.

5) I shift my stop loss to breakeven after my trade goes 1:1 in my favor.

- What was your biggest challenge in trading, and how did you overcome it?

Coping with losses has been my biggest challenge. In the past, every time I encounter a losing streak, I would start to doubt my trading system and seek to learn new systems. I would jump from strategy to strategy and not seeing success in any. I have lost so much money throughout my 1 year of trial and error to the point where I was about to give up trading for good. But I told myself since I have already lost so much, I have to make this work no matter what and I really have got nothing to lose. I settled on one system and made a commitment to trade that system consistently without any deviation and doubt.

- What was the key moment of your trading career?

The key moment was when I had a paradigm shift in my trading psychology. I learnt that trading success is 20% technical analysis, 30% money management and 50% trading psychology. I learned to think in terms of probabilities and statistics which enabled me to trade with an objective state of mind with little emotions. I used to look at trading in the perspective of a gambler. Now, I see myself as the casino.

- What do you think are the most important characteristics for maintaining a stable trading career?

1) Find a strategy that gives you a statistical edge in the market with positive expectancy.

2) Practise good money management and position sizing.

3) Master trading psychology to have the discipline and confidence to execute steps 1 and 2 consistently without deviation day after day.

4) Adopt a fire and forget approach. Do not constantly monitor your trade or the chart once you execute the trade, go do something else.

- Do you apply any mental/psychological routines while trading? Please elaborate.

Every morning when I wake up, I meditate to have a clear state of mind for the day. I also wrote down 12 trading psychology mantras inspired by Mark Douglas on a whiteboard and I read all of them before I place any trade.

- What was your strategy for successfully passing The 5%ers’ Evaluation Program?

Risk management was the key to my success. My strategy was to risk 0.3% per trade in the beginning in order to avoid the maximum drawdown. Then after I was positive in the account, I then increased my risk to 0.5%. Because 5%ers is so generous with the dateline, you can be patient and not rush the evaluation.

- Please share your recommendations for online resources that were/are significant in your trading development.

Trading podcast: Desire To Trade by Etienne Crete, Chat With Traders Trading psychology: Mark Douglas, Adam Khoo Trading books: Trading in the zone, The Disciplined Trader, TurtleTrader

- Would you like to share anything else with us?

Thank you 5%ers for the opportunity. Looking forward to working together.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

Subscribe to our youtube channel.