The Forex market is the world’s most liquid and largest financial marketplace, with traders exchanging over $7.5 trillion daily. Furthermore, the open market offers an opportunity for traders to gain from the fluctuations in exchange rates. While many currency pairs exist, traders find highly volatile pairs particularly attractive for earning good returns. You are probably wondering: What are the most volatile currency pairs to trade? The most volatile currency pairs to trade include USD/TRY (US Dollar/Turkish Lira), GBP/JPY (British Pound/Japanese Yen), NZD/JPY (New Zealand Dollar/Japanese Yen), USD/MXN (US Dollar/Mexican Peso), and USD/BRL (US Dollar/Brazilian Real). In this article, we look at the most volatile currency pairs, why they are volatile, and how to profit from them.

Table of Contents

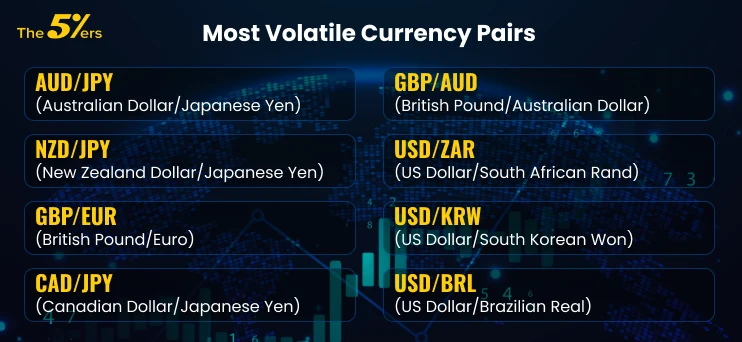

Evidently, certain currency pairs are extremely volatile, holding opportunities for enormous profits to traders. In this section, we look at some of the most volatile currency pairs and what drives their price action.

The GBP/USD currency pair, popularly referred to as “Cable” due to the historical telegraph communications between New York and London, is renowned for its huge price movements. Specifically, here are some of the reasons that make this pair volatile:

The USD/JPY pair is highly sensitive to global economic conditions and market sentiment. The following are the reasons behind its volatility:

EUR/USD is the most traded currency pair globally, and several factors affect it:

The GBP/JPY currency pair, popularly also known as the “Dragon,” is one of the most infamous for its huge price swings because of factors such as:

The AUD/USD pair is influenced by commodity prices and the overall global economic situation. Its volatility is influenced by:

Currency volatility is the degree of fluctuation in exchange rates over a specific time period. To clarify, while high volatility indicates large price movements, low volatility indicates steadier prices. Moreover, several factors influence currency volatility, such as economic indicators, political news, interest rate differentials, and market sentiment. As a result, currency traders tend to favor volatile currency pairs because they offer greater profit opportunities, albeit with greater risk.

Forex volatility measures the extent to which the price of a currency pair fluctuates over a given period. Understanding and measuring volatility is crucial for traders as it helps in assessing market conditions and making informed trading decisions. In addition, cross currency pairs, which involve currencies not directly tied to the US Dollar, can exhibit unique volatility patterns that traders must consider. Below are some of the key methods used to measure forex volatility:

Historical volatility refers to the actual volatility observed in the past. Traders calculate it using historical price data, and it provides a statistical measure of the dispersion of returns for a given currency pair. The formula typically involves calculating the standard deviation of the currency pair’s returns over a specific period.

Implied volatility is derived from the prices of options on currency pairs. It reflects the market’s expectations of future volatility. Unlike historical volatility, which looks at past data, implied volatility is forward-looking and is influenced by factors such as market sentiment and upcoming economic events.

The Average True Range (ATR) is a popular technical indicator used to measure market volatility. It calculates the average range between the high and low prices over a specified period, typically 14 days. The ATR provides a simple way to gauge the degree of price movement and is useful for setting stop-loss levels and identifying potential breakout opportunities.

Bollinger Bands consist of a moving average and two standard deviation lines plotted above and below the moving average. The width of the bands expands and contracts based on market volatility. Specifically, when the bands widen, it indicates higher volatility, and when they contract, it signals lower volatility.

Standard deviation is a statistical measure that quantifies the amount of variation or dispersion in a set of values. In forex trading, traders use it to measure the volatility of a currency pair by calculating the average deviation of the currency pair’s returns from the mean return over a specific period.

Although the VIX is primarily associated with stock market volatility, it can also provide insights into forex market conditions. The VIX measures the market’s expectation of volatility based on S&P 500 index options. A high VIX value indicates increased market uncertainty, which can spill over into the forex market.

Trading highly volatile currency pairs requires a carefully considered strategy and a complete understanding of market conditions. Therefore, here are some trading guidelines for navigating these choppy waters:

Learning effective risk management strategies is essential when trading highly volatile currency pairs. Traders should:

The use of technical analysis tools can assist in identifying potential entry and exit points. Traders should:

The application of fundamental analysis is essential to understand the causes of currency volatility. Traders must:

Psychological self-control is essential when trading highly volatile currency pairs. Therefore, traders should:

Acceptance of technology can enhance trading practices and lead to improved decisions. Traders can:

We Trade Forex – Come trade with us!

Trading currency pairs with high volatility versus low volatility involves distinct strategies and risk profiles. Understanding these differences is crucial for traders to align their trading approach with their risk tolerance and market objectives.

High-volatility currency pairs, such as USD/TRY (US Dollar/Turkish Lira) and GBP/JPY (British Pound/Japanese Yen), experience significant price fluctuations within short periods. Factors like geopolitical events, economic data releases, and interest rate differentials influence these pairs.

Low volatility currency pairs, such as EUR/USD (Euro/US Dollar) and USD/CHF (US Dollar/Swiss Franc), exhibit more stable and predictable price movements. Typically, steady economic conditions and less frequent geopolitical disruptions influence these pairs.

In forex trading, choosing between high and low volatility currency pairs presents unique challenges and rewards. For instance, high-volatility currency pairs, such as USD/TRY and GBP/JPY, offer substantial profit potential but come with increased risks and require strong psychological discipline. Moreover, successful trading with high-volatility pairs involves staying updated with geopolitical events and economic indicators that can cause sudden price swings. Therefore, traders prepare for rapid changes and implement effective risk management strategies to protect against significant losses.

On the other hand, low volatility pairs such as EUR/USD and USD/CHF provide a more stable trading environment, ideal for conservative traders who prefer predictability over excitement. Since these pairs are less sensitive to sudden market fluctuations, they are easier to analyze and forecast. Thus, trading with low-volatility pairs allows for a more relaxed approach, with less frequent monitoring and adjustments needed. This stability helps traders maintain a clearer focus on long-term strategies and goals.

Choosing between high and low volatility pairs depends largely on a trader’s risk tolerance and market objectives. While high-volatility pairs can be tempting for those looking to capitalize on short-term gains, they require a robust mindset and readiness to handle potential stress. Conversely, low-volatility pairs are suitable for traders who seek steady, predictable returns and prefer a more relaxed trading experience.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

Subscribe to our YouTube channel.

Click here to check how to get qualified.

Click here to check out our funding programs.

The5%ers let you trade the company’s capital, You get to take 50% of the profit, we cover the losses. Get your trading evaluated and become a Forex funded account trader.

Get Your Forex Funded Trading Account

You must be logged in to post a comment.