We spoke with Griff about his trading plan, insights, and lessons gained while trading in the markets and our platform as a funded trader.

Click here for more inspirational lessons and interviews with our professionally funded traders.

My name is Griff, I’m 24, born and grew up in North Wales. I’m a native Welsh speaker! I am currently living in London with my fiancé.

I’ve been trading for around four years. I started learning how to trade in April 2020, but I didn’t actually start live trading until September 2021, so I spent a lot of time practicing and backtesting.

I currently have quite a discretional trade plan, it started out mechanical but it became restrictive as I became more experienced. I realised something had to change when my gut feeling occasionally contradicted my trade plan. As a trader, I feel it’s important to follow your plan but you also need to listen to your intuition, something you will only acquire with time and experience.

I decided to scrap the mechanical trade plan completely so that I could trade more intuitively. This allows more flexibility in my decision-making but at the cost of more demanding psychology management. You should only consider going this route once you feel you’ve outgrew your trade plan and that your strategy is no longer easily quantified.

Trading is all about overcoming challenges. It feels like there has been hundreds of times where I missed a big winning trade, got tagged out of an important trade by 1 pip or made some mistake. These moments can become understandably frustrating when stacked on top of one another, especially alongside pressures to succeed. Ultimately, trading success all comes down to how you manage these frustrations and keep moving forward despite them. I know that as my career progresses these challenges will become greater and greater.

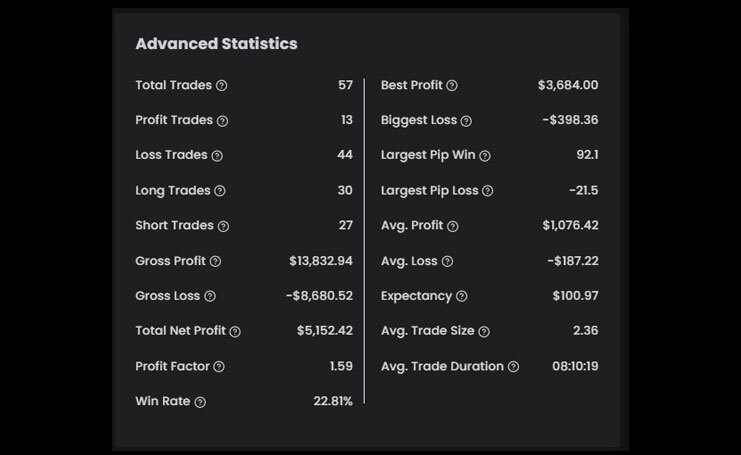

I risk 1% per trade on my personal account, I know that my system has a max DD of around 10% and that’s not considering any mistakes I may make live trading. So when it comes to prop firm accounts, I like to leave room for at least 20 losses to keep it comfortable.

For example, on my 5ers bootcamp account where I have a 4% max DD, I risk 0.25% per trade. For prop challenges, I am more aggressive, I risk enough for around 10 losses. So in the case of 5ers’ 4% max DD, I would risk 0.4% per trade.

Passing my first funding challenge in early 2022 was a huge moment for me. I’d practiced my trading strategy for around 1 year when I started the challenge. It was an incredible feeling to succeed after practicing for such a long time and to experience the fruit of my labour. Little did I know I still had so much to learn at this point, I suppose I still have much to learn even now!

Moving away from a mechanical trade plan was also quite a pivotal moment in my trading but I wouldn’t recommend this for any ‘newer’ traders. I think it’s important to make the transition from mechanical to discretional as you gain more experience.

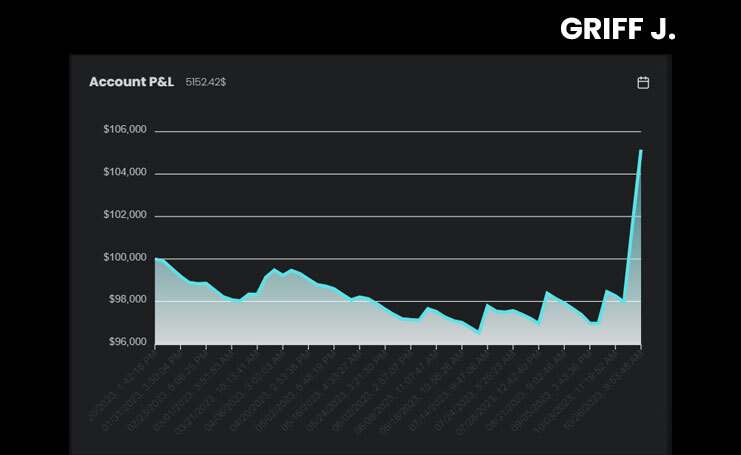

I backtested my trading strategy for around 1 year before I started live trading. So I would have navigated a few decades worth of price action. I was profitable as soon as I started live trading in September 2021, I made 12% during my first 3 months. In 2022, I made 38.85% and in 2023, I made 84.75%.

I have documented most of these trades on my YouTube channel!

I’ve always had a calm temperament, which has certainly worked in my favour for trading. Taking long walks, meditating/focusing your breathing are simple practices to become more conscious of your thoughts. I believe a lot of trading is about self-reflection and being honest with yourself. In our current era, everybody has an ego, nobody has any self awareness.

I use Zentum Trading’s strategy. It’s primarily trending entries but considering the 2023 rangebound market conditions, we’ve started developing a liquidity sweep entry to capitalise on sideways price action. It’s working well so far, producing 6% in March.

I use a much smaller risk per trade. That’s pretty much the only difference! I manage my personal account just as carefully as I manage my 5ers account.

Take your time, prop funding is just a stepping stone along a much longer path. Honestly, passing the first time may be the worst thing that could happen to you. It’ll be best for most traders to fail their first challenge, experience that feeling, take the lessons, and succeed in the future. It’s best to make mistakes early in your journey.

I’ve been through a few trading communities, while good for beginners, most only offer a one-sided education model. It’s very easy to outgrow such groups as you become more experienced.

Considering this, my friends and I created a group with a community-driven philosophy; unlike other trading communities, we encourage you to be curious. We are always open to new ideas and develop our strategy as a co-operative. It’s a place for both new AND experienced traders which I’m really proud of.

You can join our community here for free

You may also want to consider following my trading journey on YouTube. I’ve been uploading videos here since 2021, you can see a lot of my progression!

You can find my YouTube channel here

👉 If you want to receive an invitation to our live webinars, trading strategy, and high-quality forex articles, sign up for our Newsletter.

👉 Click here to check our funding programs.

Follow us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView

The5%ers let you trade the company’s capital, You get to take 50% of the profit, we cover the losses. Get your trading evaluated and become a Forex funded account trader.

Get Your Forex Funded Trading Account

You must be logged in to post a comment.